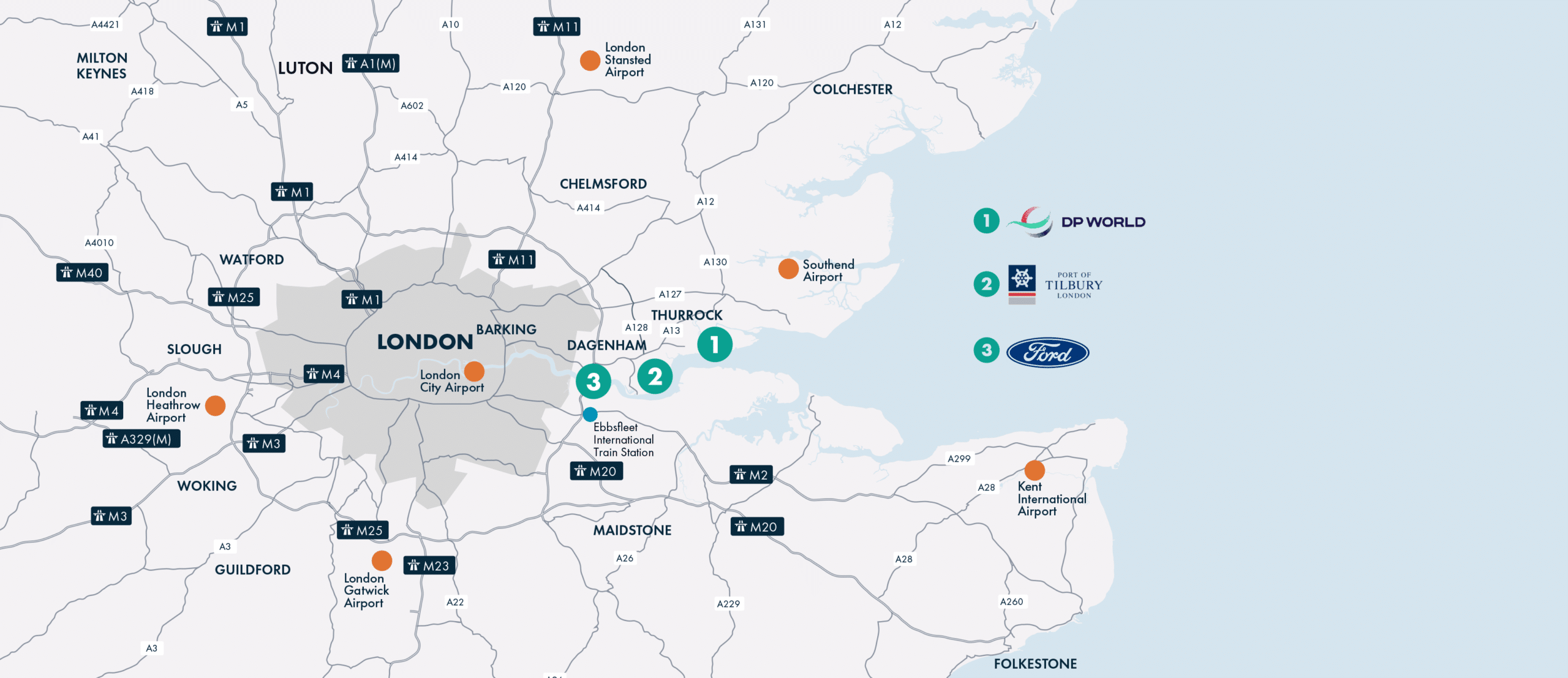

The Thames Freeport is a geographical area in the United Kingdom that has been designated as a Freeport tax site by the British government on December 15, 2021.

The Thames Freeport includes the ports of Tilbury and DP World London Gateway, as well as Ford’s Dagenham plant. The tax sites within Thames Freeport are recognised by law as areas where businesses can benefit from tax reliefs to bring investment, trade, and jobs to regenerate regions across the country that need it most. The Thames Freeport is expected to draw £4.5 billion of new investment and create 21,000 skilled jobs.

Our partners

DP World London Gateway is the UK’s largest and most integrated logistics facility, with a container port handling over 2 million units per year, a rail terminal with over 60 weekly services and a 9.25 million square foot, well connected, logistics park.

The Port of Tilbury is the largest of the Thames ports. Tilbury handles 16m tonnes of cargo per annum across 31 independent working terminals including the UK’s largest grain terminal and paper hub.

Home to Ford Dagenham, the largest manufacturing site in London, this unique location gives access to regional manufacturing clusters, proximity to suppliers, and brings key production closer to the end market.

Local government partners

Thames Freeport Benefits

40% of rent equivalent saved over first five years

0% Employer National Insurance contributions for 3 years on new jobs

10% per annum enhanced structures & buildings allowance

Lean Customs Arrangements, Duty & VAT deferment

1,243 acres (503 Hectares) of development land available

100% Business Rates Relief (5 years)

Incentives now extended to September 2031

0% Stamp Duty Land Tax

Duty exemption on goods re-exported